Inside situation, the new investor holding the fresh package until conclusion do bring beginning from the underlying asset. The new possessions inside a good futures bargain will be anything, and soybeans, coffees, oils, private holds, exchange-traded money, cryptocurrencies or a variety of someone else. Futures deals can be used by many people categories of monetary players, along with investors and you can speculators, and companies that genuinely wish to get bodily birth of your own commodity otherwise likewise have they. Futures trading lets buyers to help you secure prices for merchandise, currencies, and you may economic instruments months otherwise decades beforehand, getting a life threatening unit for handling rate exposure and you will conjecture. Field manufacturers render field liquidity by becoming happy to purchase and you may offer futures deals during the in public quoted costs.

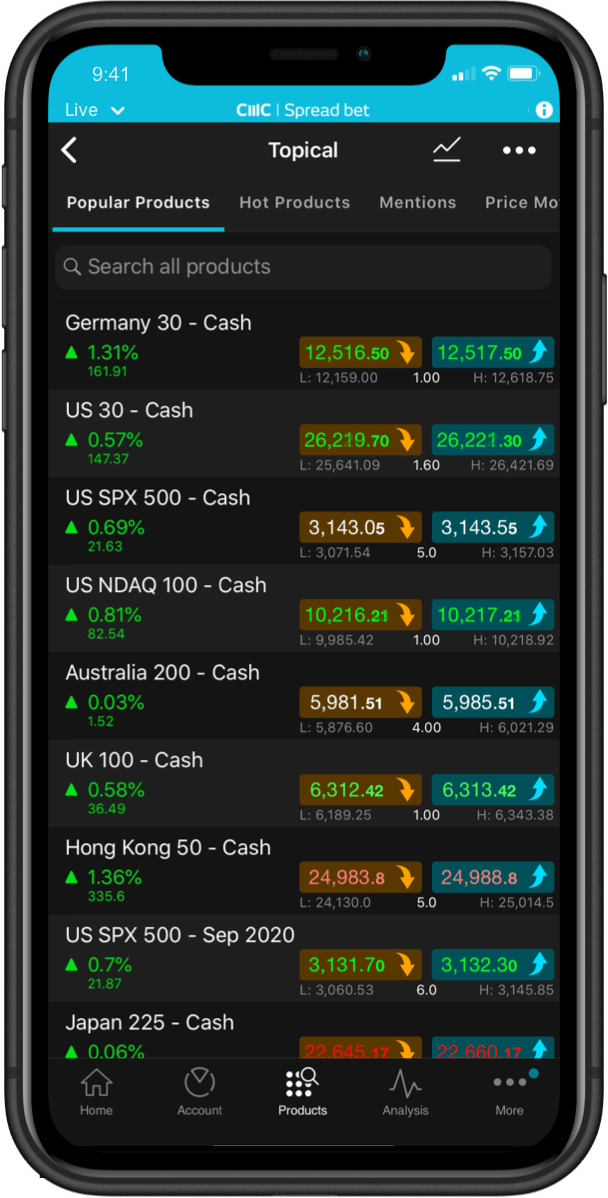

Brua invest software – Financial futures

With different futures places to pick from, you need to expose which are very-suitable for your own personal exchange layout. Particular indicator – the newest Germany 40 such – experience large volatility than the others, and could be better suited to quick-name day traders. The most basic form of futures trading uses futures and this cover cash settlement rather than bodily payment and you may wear’t features an enthusiastic expiration date. If you exchange one of them tools, the new P&L on your change will be determined by the essential difference between the purchase price from which you opened your situation and the price of which you signed it. Margin is the practice of borrowing from the bank funds from your brokerage to help you purchase. Newest margin conditions to have futures agreements is actually anywhere between 3percent and you can 12percent.

Futures deals obtain their worth from root assets, both commodities such as gold, progress, exactly what, or petroleum, otherwise economic ties for example carries or securities. Furthermore, an investor may take an extended status, which means speculating the values out of root possessions will go right up and can trade above the new rate from the bargain expiry. If that happens, they’ll money, as well as the futures offer might possibly be marketed in the most recent rate and you will finalized just before conclusion. Futures likewise have conclusion times, which means you should be careful in order to roll over otherwise intimate out positions so not to be caught which have actual delivery from unwanted commodities. First off change futures, you will need to see a broker which provides use of these types of segments and get recognition. While the a financial investment unit, futures contracts supply the advantageous asset of rates speculation and you will risk mitigation against possible market downturns.

As the brokers place her or him, they can and to improve her or him, and also the restoration margin is especially based on volatility. Like with exchange carries or other financial property, it is important to have buyers to cultivate an idea for exchange futures you to lines entry and you may get off steps and risk management legislation. In the event the a trader buys a futures offer and also the rate rises over the new bargain price at the expiration, there’s a return. However, the newest buyer might eliminate if the commodity’s rates is actually down than the price given in the futures offer. Before conclusion, the newest futures offer—the fresh a lot of time reputation—is going to be offered during the most recent rates, closing the fresh a lot of time position. Inventory futures has specific expiration times and so are structured from the day.

«In past times, whenever people have been it cynical, locations brua invest software have brought a high-than-average return next six months (8.7percent compared to. 5.8percent) and the following the 1 year (16.8percent vs. eleven.9percent),» he proceeded. «We usually come across over-average output when traders try pessimistic and afraid, as they are now,» wrote Justin Waring, a financial investment strategist at the UBS. The new S&P five hundred seated more than 8percent below their 52-week high, since mid-day exchange Thursday. That is a great stark recovery in the declines out of early last week, if wide field list briefly joined bear business region, or a decline of more than 20percent from its recent top.

What exactly are futures deals?

The different sort of futures are list finance, currencies, energy, gold and silver coins, nutrients, cereals, livestock, food and dietary fiber, stock indicator, treasury securities, etcetera. By-product instruments vary from options because the new buyers and suppliers is actually legally obliged to purchase and sell an underlying resource through to package conclusion. Usually, the new ranking held through to the deal expires are paid in the cash. As well, remaining holdings abreast of bargain termination do demand exchange payment inside the actual birth. Inside the futures deals, leverage is used so you can enhance the potential production of changes in the expense of the root resource.

Such as, futures for a primary index including the S&P five-hundred may have deals expiring in the February, Summer, September, and you may December. The newest deal on the nearby expiration day is named the new «front-month» package, which often has the most change hobby. As the a contract nears conclusion, people who wish to manage a position generally roll-over to next available package month. Short-term buyers usually work at front side-few days contracts, while you are enough time-name people might look then out. With this discharge, Coinbase is mode another standard to your You.S. crypto futures industry, carrying out another simple to possess digital resource exchange one reflects the brand new always-to the characteristics of one’s crypto globe.

Are futures exchange including trading and investing?

Tastytrade is all of our finest selection for futures trading – especially for informal futures people. Futures costs at the tastytrade try aggressive and also the broker’s earnings for options exchange is actually in addition to this. Buyers just who love charts would like tastytrade, but it’s really worth detailing you to search-based info such reports statements and you can reviews try sparse. Futures locations are generally designed for trading around the clock, half a dozen months a week, which range from Weekend nights so you can Monday mid-day. Still, change instances can differ in line with the sort of advantage getting exchanged.

At the beginning of 2007, wheat rates began to climb up due to inclement weather standards in the secret generating regions (age.grams., Australian continent had a good drought) and you may improved demand for grain used for as well as biofuel. These problems were worse because of the low international grain stockpiles inside the decades. In the future, you will find a sharp boost in grain futures cost, getting together with number highs. Guess a couple of has a ranch and needs to amass 5,one hundred thousand bushels away from wheat inside the half a year.